“The Netherlands has a very favorable therapy for holding firms”, analyzes an knowledgeable By turning into Dutch, Ferrovial would profit from the perfect credit standing on this nation Spain wouldn’t lose a lot tax income, however the multinational’s departure sends a warning sign to the Government

“For a world in movement”. Ferrovial’s motto for just a few years would match completely with the corporate’s resolution to maneuver its headquarters from Spain to the Netherlands. In its seventy-year historical past, the development firm that started laying prepare tracks has develop into a multinational current in a dozen international locations. The world is shifting and Ferrovial has taken this step, which continues to be pending ratification on the firm’s subsequent shareholders’ assembly.

The Government started taking the information with some lukewarmness, downplaying it, till the financial vp, Nadia Calviño, spoke. Ferrovial “owes every thing to Spain”. The firm has grown largely due to the general public works that Spain has carried out with residents’ cash, Calviño highlighted in her speedy media marketing campaign to touch upon this “inaccurate” resolution.

What are the keys that led this primary giant Spanish firm to maneuver the headquarters of its guardian firm? How a lot earnings can Spain lose with this transfer? The query for the Executive shouldn’t be so fiscal however relatively one in all indicators: that a big multinational firm modifications its Spanish passport for an additional Dutch one is a warning to the Government’s insurance policies.

To start with, in case anybody doubted, the proposal is totally authorized. A European firm can change residence inside the territory, in line with the interior regulation of the EU. Ferrovial has proposed exercising that freedom, however why exactly the Netherlands?

The proposed vacation spot shouldn’t be unintended. The worldwide arm of Ferrovial has been positioned on this nation for years. 82% of the earnings is concentrated outdoors of Spain, in line with their figures. Now that Dutch firm will take up the nationwide enterprise and develop into the pinnacle of the Amsterdam-based group. It shall be just like the mom home.

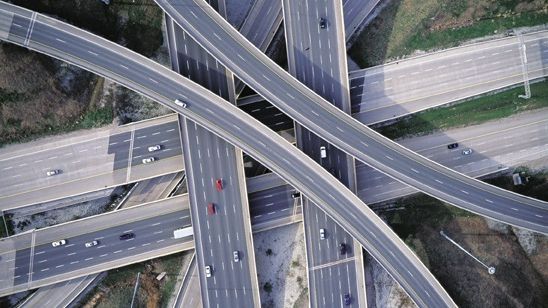

The Netherlands, nonetheless, shouldn’t be a rustic the place Ferrovial carries out a number of exercise associated to its enterprise: motorways, airport administration, tunnels, constructing initiatives… Why this vacation spot then?

The excellent place for a holding

“Holland has a very favorable therapy for holdings,” explains an knowledgeable consulted. A holding firm is “a monetary firm that owns or controls the vast majority of the shares of a gaggle of firms”, in line with the definition of the RAE.

Ferrovial has proposed that its guardian firm (or guardian firm) be its subsidiary within the Netherlands and never the one in Spain. That will power the change of venue. “It shouldn’t be a lot taking the headquarters to the Netherlands however relatively the holding firm as a result of there are various incentives to have the pinnacle of the enterprise there. There is an unbelievable facility to switch earnings from European subsidiaries to the guardian firm via a sport of retentions. It is extra a query of construction than tax charges”.

It can be true that for years the Netherlands has utilized very favorable tax regimes and has managed to draw many multinationals. Some of those schemes allowed non-EU firms to keep away from company tax. Although the European Commission has tried to restrict these practices, progress is sluggish. Organizations similar to Oxfam think about the Netherlands, together with Luxembourg and Ireland, tax havens inside the EU itself.

Less taxes

Ferrovial’s exercise in Spain will proceed to pay taxes in our nation. The firm has defined that its company plans won’t have an effect on funding or nationwide employment. The social contributions of the employees and the cost of firms, VAT and different taxes equivalent to the nationwide enterprise will proceed to be paid into the Spanish Treasury.

But the nation will lose round 40 million in taxes that Ferrovial will save, in line with calculations by Banco Sabadell, because of the switch. The firm will profit from a extra favorable taxation for the dividends of its subsidiaries (what’s entered by the earnings of investee firms). In Spain, 95% of this earnings is tax free as a result of the earnings have already been taxed of their homeland. However, within the Netherlands they’re 100% exempt.

Ferrovial assures that the change “won’t have a big influence on the taxes paid by the group.”

authorized stability

A “secure” authorized framework is one other of the explanations for the change, in line with Ferrovial. It is true that Spain has been forward in Europe with regards to imposing extraordinary taxes on the power sector and the one one which has proposed making use of it to banks. In addition, the concept of legislating “in opposition to the highly effective” has been put in within the authorities’s political discourse. In current months, a spot has opened between the president and the nation’s giant firms resulting from choices and the tone of speech.

This is the backdrop for a sector, that of development, “very topic to regulatory threat.” “I feel they’re assessing that there are going to be modifications within the coming years associated to the entire subject of the atmosphere and sustainability. They are betting that will probably be simpler to handle from the Netherlands as a result of the regulatory atmosphere there may be extra predictable than in Spain, rather more unstable now within the new measures. This is a actuality,” says an analyst.

It is a type of what’s often called ‘voting together with your toes’. An concept that we already noticed through the independence course of in Catalonia: the banks modified their headquarters. According to this concept, individuals or firms can present their preferences by not voting for a political occasion however by shifting to a different place the place fiscal, social or different concepts are extra akin.

Lower financing price

Large firms go to the markets in the hunt for financing for his or her initiatives. The curiosity that buyers ask for is generally linked to the nationality of the enterprise. The Netherlands has the best ranking and its public debt is 50% of GDP. In Spain it’s greater than double that weight: 115% GDP.

An atmosphere of rising charges just like the one we see in Europe carries the chance of decrease progress within the economies. If that materializes — a tough touchdown in exercise — probably the most indebted international locations would be the first to undergo. This might translate right into a decrease credit score high quality of the nation. Come on, extra threat and extra curiosity. The grade discount can be utilized to firms in that territory nearly mechanically. In apply, this interprets into larger financing prices for the corporate. Ferrovial values that this threat within the Netherlands is decrease and that it could additionally make the most of its good ranking within the markets.

Low reputational price

We are speaking about an organization that builds bridges, roads, manages infrastructure… The threat that a part of its shoppers will punish them for this resolution is low. Ferrovial offers with nationwide and regional governments and different non-public firms. In your case it isn’t the identical as for a monetary establishment or an organization with a retail enterprise.

We have already seen how difficult this repute administration was when entities similar to La Caixa or Sabadell moved their headquarters outdoors of Catalonia. For this cause it’s exactly why will probably be tough to see many extra circumstances like Ferrovial’s.