The rise within the Euribor triggers the mortgage quota in Spain or Italy however doesn’t have an effect on Germany or France, international locations the place custom mandates that mortgage rates of interest be mounted

The overwhelming majority of their mortgages are at a variable fee, so the will increase in Euribor, which is guided by the speed will increase of the European Central Bank (or different central banks such because the Bank of England), totally have an effect on them. In the United Kingdom there are households that pay 40% extra at present than they paid final summer season, an increase much like some mortgages in Spain. Not all of Europe is identical. Countries like Germany, France, the Netherlands or Belgium have been signing fixed-rate mortgages for many years. These international locations are affected by the rise in rates of interest from the European Central Bank as quickly because it makes credit score dearer, however it doesn’t contact their excellent mortgages, so households don’t worry that the installment on their mortgages will rise, principally signed at 20 or 30 years.

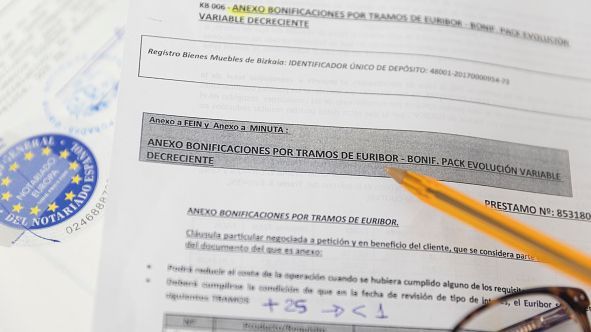

The value of cash and the price of mortgages

Benchmark rates of interest from the European Central Bank have been in destructive territory for a decade, additional boosting the attraction of variable-rate mortgages. But in just a few months, with a number of will increase, they have been planted at 3.5%. It is the largest rise because the creation of the euro and it’s a phenomenon that can be taking place in international locations exterior the widespread foreign money, comparable to some in Eastern Europe or the United Kingdom.

If in Spain there’s a speedy rise within the installments to be paid for many who signed mortgages at variable charges, the Spanish case just isn’t essentially the most excessive in Europe. The rise is such in Sweden and the UK that it has already induced home costs to fall as gross sales collapsed. The value of the sq. meter in Sweden fell by 12% in a single 12 months and within the United Kingdom by 4% because the finish of summer season.

Are we on the verge of an actual property disaster just like the one unleashed by the monetary disaster of 2008? A supply within the European Commission believes that banks are actually extra shielded from default as a result of they have been stricter in granting mortgages and since unemployment is decrease, however doesn’t completely rule out the chance that the Swedish state of affairs is repeated in different European international locations.

Are there options?

That similar supply estimates that attempting to get the European Central Bank to boost or decrease rates of interest as a result of in some international locations mortgages got at variable charges as an alternative of mounted charges is much from the mandate of the Eurobank except it considers that an actual property disaster linked to this phenomenon impacts to the monetary stability of the Eurozone. But there are nationwide patches: whereas Spain for now doesn’t transcend the banking code of fine follow, in Sweden the controversy focuses on the necessity to approve a moratorium on mortgage mortgage repayments or put a most restrict as much as which Mortgages can rise irrespective of how a lot the Euribor rises.